Apr 30, 2018 19:00 JST

Source: Warc

Source: Warc

|

|

|

Radio ad investment stable, but the rise of digital audio presents a new frontier

Global Ad Trends - A focus on radio and digital audio advertising

LONDON, Apr 30, 2018 - (ACN Newswire) - Radio and digital audio advertising is the focus of WARC's latest monthly Global Ad Trends report, digesting up-to-date insights and evidenced thinking from the worldwide advertising industry.

| |

| | Spend on digital audio formats is rising in the US |

Following an analysis by WARC, the international authority on advertising and media effectiveness, of its data for the 96 markets included in its Adspend Database, radio advertising spend was found to have amounted to $32bn worldwide in 2017, and is expected to rise by 1.3% this year.

Broadcast radio reaches three-quarters of homes across key markets each week

On average, radio reaches 75% of households every week across WARC's 12 key markets - Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Russia, United Kingdom and United States. Data show that reach is highest in China at 98% or 457.5m homes in 2017. While the equivalent share drops to 77% in the US, the 97.2m households reached is the second-highest total among the measured markets.

Broadcast radio has gained share of total display spend in the majority of key markets, most notably China

Data show that while broadcast radio's share of global display advertising spend has decreased by 1.6 percentage points (pp) to 7.2% over the decade to 2017, the medium has gained share of display spend in the majority of key markets since 2008 - most notably in China, the world's second-largest radio market with spend of $6.5bn. This equated to a 6.4% share of all Chinese display spend last year, up 1.2pp since 2008.

Radio's share was also up in India (+0.6pp), Germany (+0.5pp), Australia (+0.5pp), Canada (+0.5pp), Italy (+0.1pp) and France (+0.1pp) over the period.

Much of radio's global share has been eroded by a dip of 4.0 percentage points in the US, the world's largest radio market at $13.6bn in 2017 (44.1% of all radio spend worldwide). With the US removed, radio's share of display adspend has grown globally by 1.0pp over the last ten years.

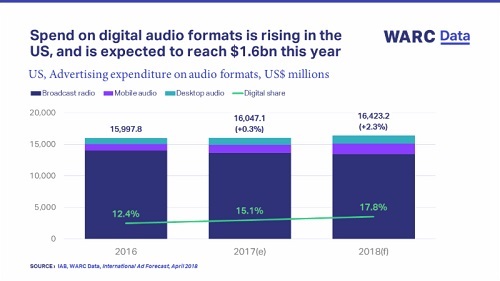

Spend on digital audio formats is rising in the US, and is expected to reach $1.6bn this year

While spend on broadcast radio has fallen in the US each year since 2012, US advertisers are investing more heavily in digital audio formats, particularly on streaming platforms such as Spotify.

39 million American adults now own a smart speaker, and two in five (39%) are using it at the expense of traditional AM/FM radio. However, 71% of owners say they are listening to more audio since purchasing a smart speaker.

WARC believes US advertisers will spend $1.6bn on digital audio advertising this year, most of which (81.3% - $1.3bn) will be delivered via mobile devices. Separate research in the UK shows the targeting capabilities of digital audio advertising are particularly attractive to practitioners. The finding comes at a time when company reports show that almost half (49%) of Spotify's ad impressions were delivered programmatically - by utilising consumer data - last year.

Podcast sponsorship offers consumers a clear valueexchange

While podcast advertising is nascent, data show that the format outperformed pre-roll video in driving purchase intent in 57% of cases. Almost four in five (78%) US consumers said that they did not mind the ads or sponsorship messages because they knew they were a means of supporting the podcast. This suggests that most consumers understand the value exchange of podcast advertising.

Summing up, James McDonald, Data Editor, WARC, says: "Broadcast radio continues to be a staple for advertisers, and its share of display investment has grown in the majority of key markets, most notably China, where reach is high and CPMs are low compared to other media.

"In the US, advertisers are investing more in digital audio, lured by the format's targeting capabilities on platforms such as Spotify. Podcast sponsorship also presents an opportunity, as consumers seem willing to tolerate advertising in exchange for supporting the content they love."

Global media analysis: A round-up of radio and digital audio

16% of US consumers who already own a smart speaker

18% of audio adspend directed towards digital formats in the US

57% of podcast ads that outperformed pre-roll video in lifting purchase intent

62% of marketers who agree improved targeting will lead to an increase in digital audio advertising

64% of internet users who also use an online audio streaming service

75% average household reach for broadcast radio across key markets

Other new key media intelligence on WARC Data

Spotify valued at GBP 23.5bn after IPO, despite losses more than doubling to GBP 1.2bn in 2017

Search and social media contributed 85% of UK market growth last year

Facebook click through rates dipped in all measured markets during March

Video accounts for a quarter of online display spend in India

Global Ad Trends is part of WARC Data, a dedicated online service featuring current advertising benchmarks, data points, ad trends and user-generated expanded databases.

Aimed at media and brand owners, market analysts, media, advertising and research agencies as well as academics, WARC Data provides current advertising and media information, hard facts and figures - essential market intelligence for ad industry related business, strategy and planning required in any decision making process.

WARC Data is available by subscription only. For more information visit www.warc.com/data

Contact:Amanda Benfell

PR Manager

+44 20 7467 8125

amanda.benfell@warc.com

Source: Warc

Sectors: Media & Marketing, Advertising

Copyright ©2024 ACN Newswire. All rights reserved. A division of Asia Corporate News Network. |

Latest Release

First-ever Mazda CX-80 Crossover SUV Unveiled in Europe

Apr 19, 2024 13:50 JST

|

Fujitsu develops technology to convert corporate digital identity credentials, enabling participation of non-European companies in European data spaces

Apr 19, 2024 10:17 JST

|

Mitsubishi Heavy Industries and NGK to Jointly Develop Hydrogen Purification System from Ammonia Cracking Gas

Apr 18, 2024 17:01 JST

|

Toyota Launches All-New Land Cruiser "250" Series in Japan

Apr 18, 2024 13:39 JST

|

Fujitsu and Oracle collaborate to deliver sovereign cloud and AI capabilities in Japan

Apr 18, 2024 11:14 JST

|

Eisai: Research on Treatments for Alzheimer's Disease Based on Its Pathological Mechanisms Recieves Award for Science and Technology (Research Category)

Apr 18, 2024 10:53 JST

|

All-New Triton Confirmed as First Double-Cab Pickup Truck to Achieve 2024 Five-Star ANCAP Safety Rating

Apr 18, 2024 09:22 JST

|

Eisai's Antiepileptic Drug Fycompa Injection Formulation Launched In Japan

Apr 17, 2024 16:17 JST

|

Honda Unveils Next-generation EV Series for China

Apr 17, 2024 12:15 JST

|

Lexus presents Time at the 2024 Milan Design Week

Apr 16, 2024 18:49 JST

|

Mitsubishi Corporation Announces Participation in a DAC Project in Louisiana, USA

Apr 16, 2024 14:36 JST

|

New circuit challenge for TOYOTA GAZOO Racing

Apr 15, 2024 17:21 JST

|

TOYOTA GAZOO Racing back on asphalt for Croatian challenge

Apr 12, 2024 19:36 JST

|

Heidelberg Materials North America Announces Latest Milestone in Edmonton CCUS Project

Apr 12, 2024 14:39 JST

|

MHIAEL Completes Expansion of the its Nagasaki Plant for Manufacture of Aero Engine Combustors

Apr 11, 2024 18:08 JST

|

Mitsubishi Shipbuilding Acquires Approval in Principle (AiP) from Classification Society ClassNK for Ammonia Fuel Supply System (AFSS)

Apr 11, 2024 17:50 JST

|

DOCOMO, NTT, NEC and Fujitsu Develop Top-level Sub-terahertz 6G Device Capable of Ultra-high-speed 100 Gbps Transmission

Apr 11, 2024 15:10 JST

|

Mitsubishi Corporation Announces Completion of Capital Raise by Nexamp

Apr 11, 2024 13:07 JST

|

Mitsubishi Shipbuilding Receives Order for Ammonia Fuel Supply System for Ammonia-Powered Marine Engine

Apr 10, 2024 16:55 JST

|

Transgene and NEC Present First Clinical Benefits of Neoantigen Cancer Vaccine, TG4050, in Head & Neck Cancer at AACR 2024

Apr 10, 2024 13:36 JST

|

More Latest Release >>

|