KARIYA, JAPAN, June 3, 2025 - (JCN Newswire) - DENSO CORPORATION, a leading mobility supplier, has announced that, at the meeting of the Board of Directors held on June 3, 2025, it has decided to sell its shares in Toyota Industries Corporation and to conduct an advance notice of a tender offer for its own shares held by Toyota Industries.

Aiming to resolve social issues while realizing business growth, DENSO is engaged in the creation of corporate value with the aim of maximizing ROE*, guided by management with an awareness of capital costs, under its renewed financial strategy commencing in 2021. To this end, DENSO is driving a financial strategy supported by four pillars: (1) reinforce profit structure, (2) reduce low-profit assets, (3) improve capital structure, and (4) engage in dialogue with markets.

The Transaction, proposed by Toyota Fudosan Co., Ltd., aims to further strengthen collaboration among Toyota Group companies through Toyota Industries shares private. In alignment with this proposal, DENSO has decided to implement the initiative as outlined below, as a means to accelerate the aforementioned financial strategy.

Sale of DENSO’s Shareholding in Toyota Industries

With due consideration of the impact on the market supply and demand of the shares, DENSO had been proceeding with a phased sale of its shares in Toyota Industries over a two-and-a-half-year period starting in March 2024. Considering the tender offer for shares of Toyota Industries announced today by Toyota Fudosan, DENSO has decided to cancel the phased sale and instead to tender its shares in the tender offer. This enables DENSO to execute a quicker and assured bulk sale under more favorable conditions compared to selling on the market.

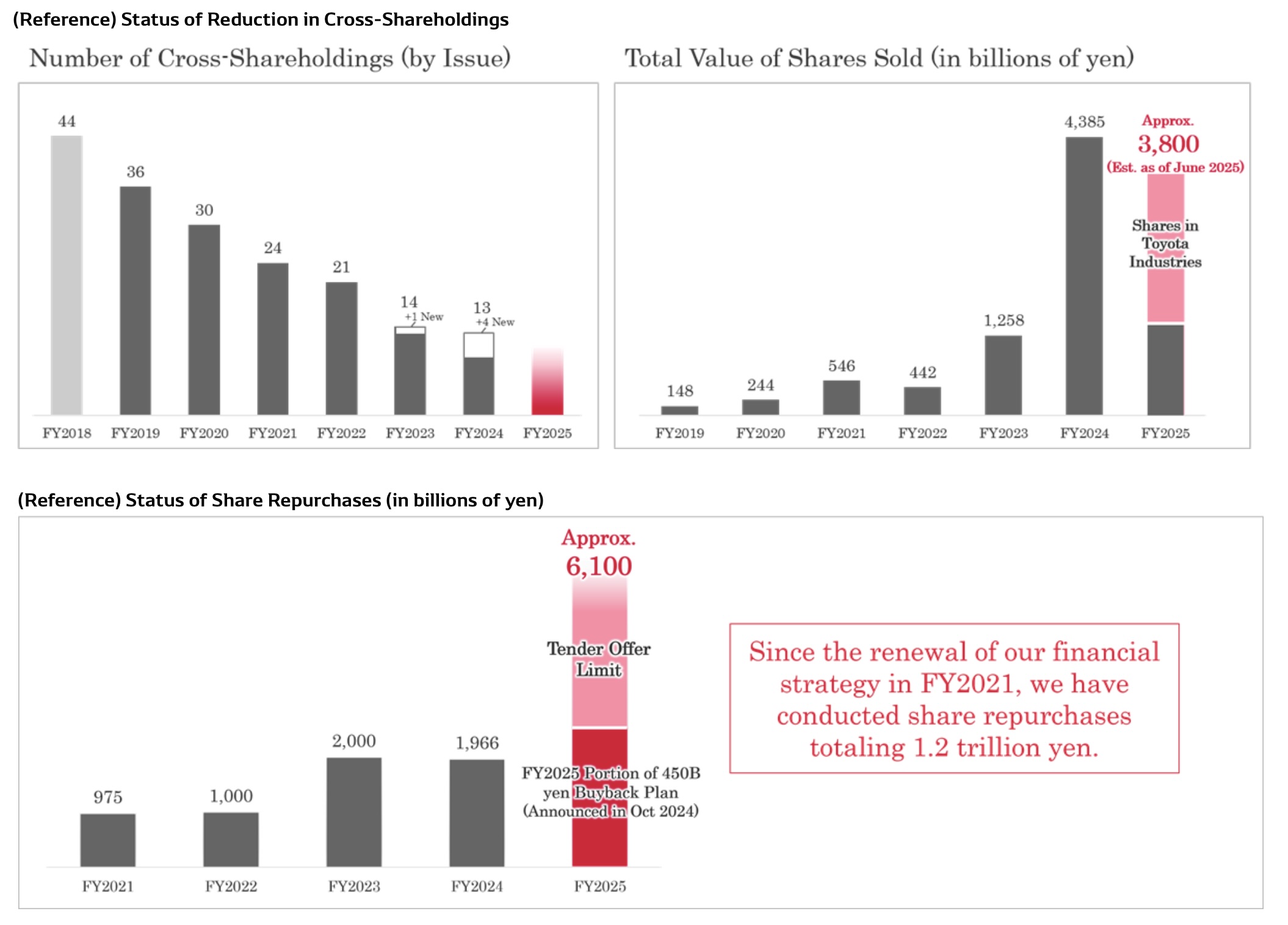

As part of the efforts to reduce cross-shareholdings, the total value of shares sold in FY2024 reached a record high of 438.5 billion yen. In FY2025, together with the planned sale of shares in Toyota Industries, DENSO expects to generate cash proceeds exceeding 380 billion yen.

Advance Notice of Tender Offer for Own Shares

DENSO has decided to conduct an additional share repurchase in response to the confirmed intention of a large portion sales of DENSO shares held by Toyota Industries. By conducting the tender offer, DENSO can dispel concerns about supply-demand imbalance resulting from the sale and purchase the shares applying a discount to the market price.

In FY2025, DENSO plans to conduct share repurchases totaling approximately 610 billion yen, comprising the remaining 250 billion yen from the market buyback program announced in FY2024 and up to 358 billion yen through the self-tender offer from Toyota Industries. This will represent the largest share repurchase in DENSO’s history.

DENSO is committed not only to continuously improving its capital structure, but also to allocating resources toward growth investments that accelerate the transformation of its business portfolio. DENSO will continue striving to enhance corporate value in a way that resonates with its stakeholders.

*ROE: Return on Equity