|

Hektar REIT Realised Net Income higher by 187% for FY2022

- Revenue is substantially higher by 21.6%

- Significantly improved Net Property Income by 24.8%

- High dividend yield of 11.4% and impressive Annual Return of 60.8%

- Increase in Hektar REIT Portfolio Valuation by RM41.6 million

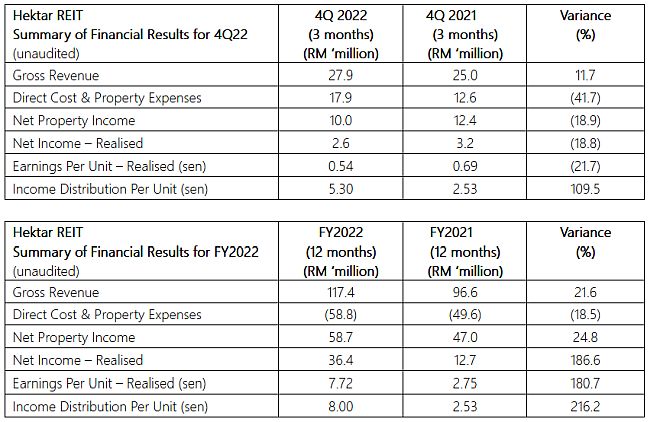

KUALA LUMPUR, Feb 23, 2023 - (ACN Newswire) - Hektar Asset Management Sdn. Bhd., the Manager of Hektar Real Estate Investment Trust (Hektar REIT), today announced its annual year results for the financial year ended 31 December 2022 (FY2022) with revenue of RM117.5 million, a substantial increase of 21.6% compared with the RM96.6 million for FY2021. The higher revenue is attributed to the increased rental income, including high turnover rent, increased car park income and higher hotel occupancy with an increase in the average room rates. Hektar REIT registered a Net Property Income (NPI) of RM58.7 million, a significant increase of 24.8% compared to RM47 million in the preceding year. Realised Net Income was RM36.4 million, a notable increase of 187% compared to the previous year. The dividend yield for FY2022 was 11.4% which was higher than the pre-Covid period (FY2019), with an impressive annual return of 60.8% based on the share price performance. The Net Asset Value (NAV) per unit for FY2022 was at RM1.27, an increase of 9% compared to RM1.16 in the previous year. There was also a notable increase in the fair value of the Hektar REIT Investment Portfolio of RM41.6 million.

| |

| | En. Johari Shukri Bin Jamil, Chief Executive Officer of Hektar Asset Management Sdn. Bhd |

Portfolio Performance for FY2022:

FY2022 was the year of recovery for the retail sector after the Covid-19 pandemic and the various restrictions & closures it brought. Hektar REIT's portfolio occupancy showed resilience at 82% as the majority of its assets maintained more than 80% occupancy rate. Our mall, Kulim Central, located in Kedah, continues to grow post refurbishment as its occupancy exceeds 96% with a double-digit valuation increase year-on-year. The Management successfully managed to attract 178 new & existing tenants, covering 22.8% of the total Net Lettable Area (NLA), equivalent to 466,357 sq. ft.

Despite the challenging retail environment, the Management remains steadfast in boosting occupancies by focusing on retaining key tenants, reviewing its current mall strategies, and working with innovative and creative retailers who are expected to bring the desired impact to the mall. According to the Manager, good brands are still expanding and in 2022, new & refreshed retailers were introduced in the malls, such as 4Fingers Crispy Chicken, Machines, Sushi Go, Oppo, Switch, Samsung, Myeong Dong Topokki, Siam Restaurant, Gigi Coffee, Yole Yoghurt, Rollney, Felancy, Pierre Cardin, Vivo and Madam Croffle to name a few.

All malls under the portfolio experienced an uptrend in visitor traffic following Malaysia's transition to endemicity after the COVID-19 pandemic, showing positive signs of a return in shoppers' confidence at Hektar malls. Overall visitor footfall count increased to 21.1 million in 2022, a massive jump of 60% compared to last year. It was primarily due to the intensified marketing initiatives, including sales-driven promotional campaigns, various events & activities that were implemented to cater to our loyal shoppers & patrons and Corporate Social Responsibility related events to serve the communities in which our shopping centres operate. All these initiatives have assisted our tenants' sales to inch closer to pre-pandemic levels of 2019 and helped them improve their cash flow by enjoying reduced occupancy costs.

En. Johari Shukri bin Jamil, Chief Executive Officer of Hektar Asset Management Sdn. Bhd. said: "Hektar REIT has shown tremendous persistence & resilience in FY2022 and has worked closely with our tenants, shoppers & other key stakeholders. Malls are evolving into lifestyle-centric places for people to meet, socialise, interact and learn. We are confident and believe they will remain the preferred destinations for entertainment, social activities and shopping amongst Malaysians as long as our malls stay relevant."

"Our focus is on initiatives that will benefit our malls and retailers in the long run through implementing focused strategies that will bring improvements in visitor footfall and encourage higher customer spending, resulting in a continuous positive upward cycle and sustainable growth. Our results for FY2022 have shown that our strategies are yielding the desired results. However, we remain cautiously optimistic about the 2023 outlook given the volatile economic landscape driven by hawkish monetary policy in response to inflationary pressure. We will continue to work harder to provide a fulfilling shopping experience to our loyal patrons and sustainable returns to our Unitholders."

Sustainability & ESG Awards for FY2022:

Hektar REIT embarked on energy efficiency & optimisation initiatives in 2017, in line with our commitment and goal to reduce our carbon footprint. The Management Team has been clear on its sense of responsibility, commitment and sincerity towards implementing initiatives and strategies that mitigate climate change associated risks, provide a positive impact on the community, uphold the best governance practices which are also aligned with United Nations Sustainable Development Goals (UNSDGs).

Hektar REIT is a constituent of the FTSE4Good Bursa Malaysia Index and the rating was upgraded from a 3-star to a 4-star in its latest evaluation by FTSE Russell in June 2022. The Management team remains committed to continuously looking at and adopting sustainability-linked initiatives as part of the core strategy & decision-making process. We will continue to enhance our efforts in managing material sustainability matters, including climate change adaptation, pollution prevention, water and waste management, and managing energy consumption, including incorporating renewable energy in our energy mix moving forward. Hektar REIT's Assets Under Management (AUM) comprise five neighbourhood malls and one regional mall. Since acquiring these properties, our focus has always been on serving our community.

For FY2022, Hektar REIT's efforts have been recognised and rewarded with three awards for Sustainability & ESG Initiatives:

- Hektar REIT has been awarded "Company of the Year" under the "Stakeholder and Community Sustainability Engagement Initiatives" category of the Sustainability & CSR Malaysia Awards 2022.

- Hektar REIT was awarded two Silver awards at The Edge Malaysia ESG Awards 2022:

-- Most Improved Performance Award Over Three Years (for Market Cap below RM300M); and

-- Property & REIT Sector Award.

The awards recognise and honour Malaysian companies' commitment to developing and enhancing their business operations according to the Environmental, Social and Governance (ESG) principles.

4Q 2022 Financial Results:

For the fourth quarter ended 31 December 2022 (4Q 2022), Hektar REIT recorded revenue of RM27.9 million, which is 11.7% higher than RM25 million for 4Q 2021. Net Property Income was RM10 million for the quarter under review, which was lower by 18.9% compared to the RM12.4 million in the corresponding quarter of the previous year due to the higher upkeep, repair & maintenance expenses that were incurred to cater for improving domestic demand & normalisation of economic activities.

Hektar REIT: http://www.hektarreit.com/

Source: Hektar REIT

Sectors: Daily Finance, Real Estate & REIT, Daily News, Local Biz

Copyright ©2025 ACN Newswire. All rights reserved. A division of Asia Corporate News Network. |