Boca Raton, FL, Dec 4, 2023 - (ACN Newswire) - Atlas Lithium Corporation (NASDAQ: ATLX) (“Atlas Lithium” or “Company”), a leading lithium exploration and development company, is pleased to announce full funding for its early revenue strategy designed to allow the Company to be in production in Q4 2024. Atlas Lithium has estimated the total Phase 1 capital expenditures (“CAPEX”) to be US$ 49.5 million for the implementation of mining and production of spodumene concentrate at its lithium project in Brazil's Lithium Valley. This CAPEX is now funded by the US$ 50 million secured from lithium industry leaders Yahua and Chengxin as described in this press release.

HIGHLIGHTS

- Direct investment at a premium into Atlas Lithium and offtake agreements for Phase 1 of Atlas Lithium’s battery grade spodumene concentrate production have been executed with two top lithium chemical companies, Chengxin Lithium Group and Yahua Industrial Group, suppliers of lithium hydroxide to Tesla, BYD, and LG, among others. Goldman Sachs served as financial advisor to Atlas Lithium in these transactions.

- Chengxin and Yahua have committed an aggregate of US$50 million to Atlas Lithium with US$10 million as equity at $29.77 per share (a 10% premium to recent VWAP) and US$40 million as non-dilutive prepayment in exchange for 80% of Atlas Lithium’s Phase 1 lithium concentrate production.

- With these transactions, Atlas Lithium is fully funded for its estimated total CAPEX to first production of US$49.5 million.

- The accelerated production timeline will be achieved by deploying modular DMS technology and contracting the initial crushing and mining operations with local third parties. The DMS plant for Phase 1 has already been designed and purchased; it is being constructed at an expert facility and will be air freighted into Brazil in 2024.

- Phase 1 annualized production targets up to 150,000 tonnes per annum (“tpa”) of battery grade spodumene concentrate by Q4 2024, with the offtake agreements announced today comprising 120,000 tpa in total and with each party receiving 60,000 tpa. Atlas Lithium’s planned Phase 2 aims to increase capacity to 300,000 tpa by mid-2025. Phase 2 capacity remains uncommitted.

- Atlas Lithium is well-positioned to become one of the highest-quality, lowest-cost lithium producers in the world. DMS is an environmentally sustainable technology, and the Company’s project has strong support from the community where it operates.

Offtake Agreements

The high quality of Atlas Lithium's spodumene, further validated by extensive metallurgical test work, along with the project's amenability to open pit mining and simple dense media separation (“DMS”) processing, generated robust interest from global parties looking to invest and partner with the Company. After a process which included project site visits from multiple parties, Atlas Lithium chose to partner with Chengxin and Yahua, two of the world's largest lithium hydroxide producers. Atlas Lithium’s battery grade spodumene concentrate is a product tailored to be used in chemical conversion plants that will process it to lithium hydroxide, the next step in the processing of lithium towards eventual use in batteries. With excellent technologies, strong relationships with top-tier customers such as BYD (the largest global EV maker), Tesla (the second largest), and LG, among others, and a commitment to high-quality, sustainable lithium production, Chengxin and Yahua share Atlas Lithium's vision to power the accelerating global transition to green energy. Furthermore, Atlas Lithium’s business development team did not want to rely on placing the Company’s product on the spot market as the vagaries of such approach are much less economically attractive than securing purchasing agreements with Tier 1 customers such as Yahua and Chengxin.

Shenzhen Chengxin Lithium Group Co., Ltd (“Chengxin”) was established in 2001 and is headquartered in Chengdu, China. It is listed on the Shenzhen Stock Exchange with a market capitalization of approximately US$2.8 billion. Chengxin’s core business is production and sales of lithium battery materials. The main products are lithium concentrate, lithium carbonate, lithium hydroxide, lithium chloride, and lithium metal. At present, the Company has built a total production capacity of 72,000 tons of lithium chemicals in Deyang and Suining. Chengxin is currently building out new capacity of 60,000 tons of lithium chemical project in Indonesia which was expected to be completed by the first half of 2024. Chengxin’s main customers include BYD, CATL, LG Chemical and other industry leading enterprises.

Sichuan Yahua Industrial Group Co., Ltd (“Yahua”) was founded in 1952 and is headquartered in Chengdu, China. It is listed on the Shenzhen Stock Exchange with a market capitalization of approximately US$2.2 billion. Yahua is a diversified chemical company engaged in the production and sale of lithium chemical products among others. Yahua currently has an annual lithium chemical production capacity exceeding 70,000 tons, including industrial and battery grade lithium carbonate and lithium hydroxide. Yahua plans to expand its lithium salt production capacity to over 100,000 tons by 2025. Yahua’s main customers include CATL, Tesla and LG Energy Solutions.

Nick Rowley, Atlas Lithium’s VP of Business Development, said, “I had the opportunity to work with both Chengxin and Yahua during my time at Galaxy Resources (now Allkem). These two companies were among the top purchasers of product from Galaxy and integral to our success there as major offtake partners of the Mt Cattlin lithium mine in Western Australia. I am thrilled to have secured their support for Atlas Lithium which is now poised to become the next high-quality lithium concentrate producer in Brazil’s globally renowned Lithium Valley region.”

Marc Fogassa, the Company’s CEO and Chairman, added, “I am humbled by the robust interest multiple parties demonstrated in Atlas Lithium. Ultimately, we opted to partner with two exceptional firms that rapidly and proactively pursued this opportunity to fruition. The ability to become a lithium producer with minimal dilution to shareholders is a significant accomplishment. Securing strong customers with premier end-users is also pivotal to Atlas Lithium’s ambition to become a significant supplier of high-quality lithium. This announcement thus signals a watershed moment for Atlas Lithium’s pursuit of Tier 1 producer status.”

Details of the agreements described in the press release can be found on a Form 8-K which the Company has filed today with the Securities and Exchange Commission. The offtake agreements carry a 5-year term while allowing for early termination should Atlas Lithium undergo a change of control transaction. The Company considers that it received highly attractive pricing on the offtake agreements because of the quality of its spodumene and the credibility of its team. Pricing for the periodic sales of Atlas Lithium’s battery grade spodumene concentrate will be calculated by a formula based on the price of lithium hydroxide globally. The price of lithium hydroxide is defined by historical data for the import and export pricing in China, Japan and South Korea, as determined by major cathode makers.

Early-Revenue Strategy

With the well-delineated initial Anitta pegmatites and positive metallurgical test work results, Atlas Lithium’s technical team opted to expedite the production timeline for its 100%-owned Neves Project. The original target of 300,000 tpa of spodumene concentrate output remains on track for 2025 as Phase 2. However, the Company now targets to commence the initial production of up to 150,000 tpa of spodumene concentrate by Q4 2024. This accelerated production timeline will be enabled by deploying modular DMS technology and contracting initial crushing and mining operations. The total CAPEX until the initial production and revenues is estimated at US$ 49.5 million, which includes the modular DMS plant already purchased along with all civil construction and mining implementation work, and a contingency reserve.

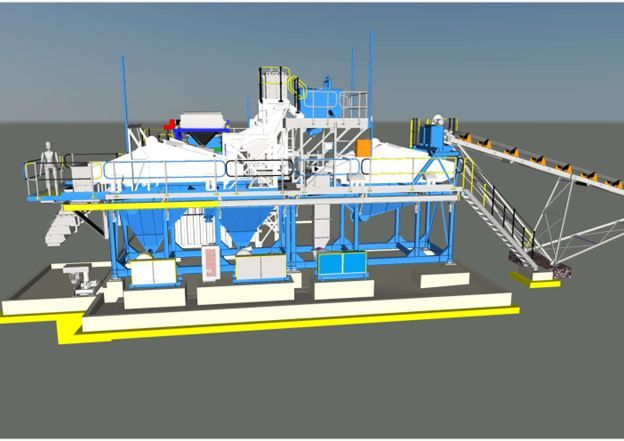

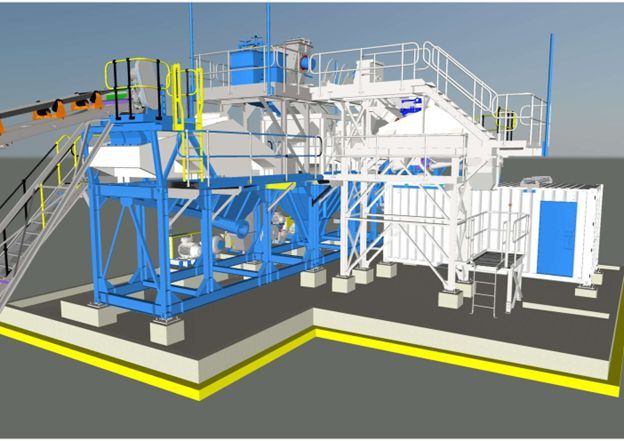

To enable the accelerated production schedule, the Company will utilize modular DMS processing plants, a design and approach not yet utilized in lithium processing in Brazil, and which allows for expedited construction. Figures 1 and 2 show the overall design for Atlas Lithium’s modular plant, with a targeted nameplate capacity of up to 150,000 tpa of spodumene concentrate. The first two DMS modules for Phase 1 are currently under construction with an estimated delivery date to Brazil by April 2024.

Figure 1 – Atlas Lithium’s designed modular DMS plant with a targeted nameplate capacity of up to 150,000 tpa of spodumene concentrate.

Figure 2 – Rotated view of Atlas Lithium’s designed modular DMS plant design with a targeted nameplate capacity of up to 150,000 tpa of spodumene concentrate.

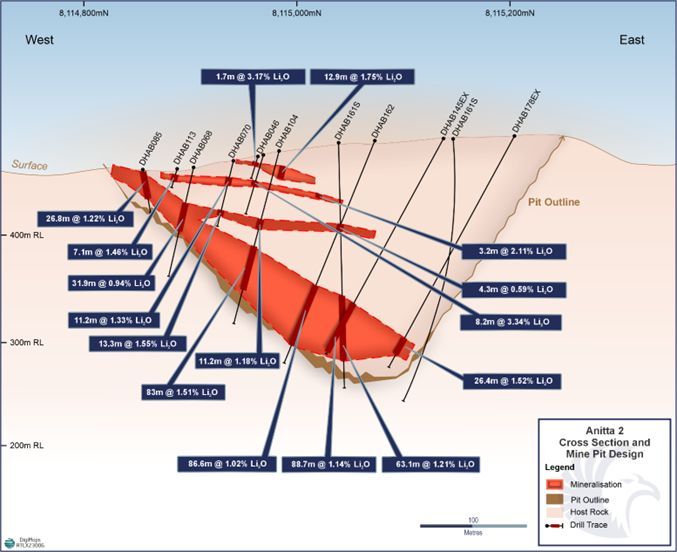

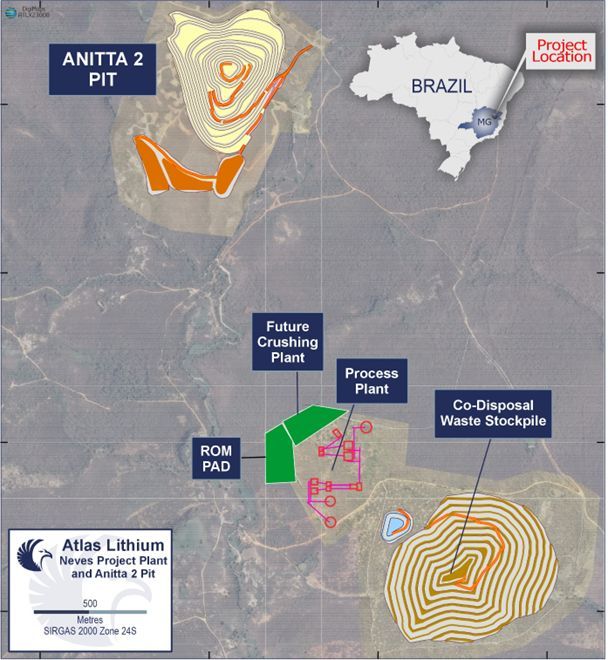

Mine development has also progressed significantly, with well-defined ore bodies that have enabled the Company to develop a comprehensive mining schedule. The geological modelling team has completed a detailed block model of the initial pit area, which has facilitated the design of an optimal open-pit outline by outside consultants. The initial mining plan is focused on the Anitta 2 and 3 pegmatites with Figure 3 illustrating the cross-section with an overlying pit shell for Anitta 2, the location of the starting open-pit mine. The processing plant and Anitta 2 open-pit layout can be seen in Figure 4.

Figure 3 – Cross-section with an overlying pit shell for Anitta 2, the location of the first open-pit mine.

Figure 4 – Neves Project processing plant and Anitta 2 open-pit layout

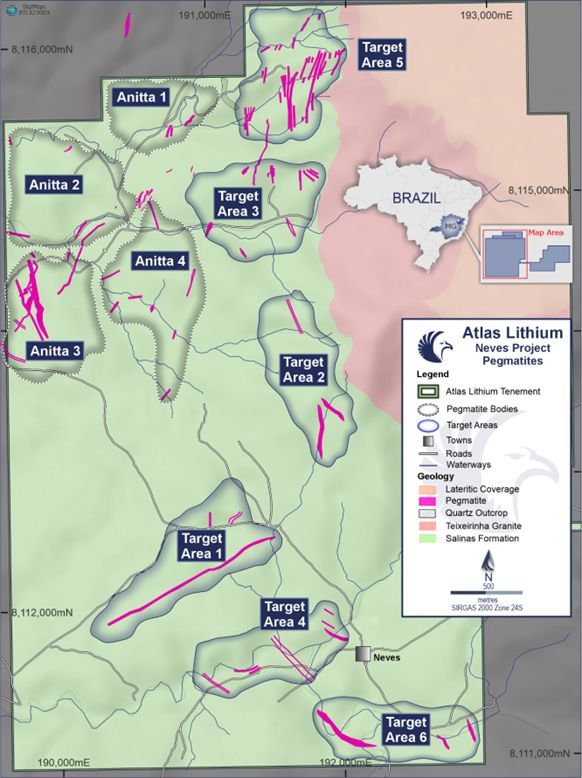

In parallel with its accelerated effort to commence production in 2024, the Company continues an aggressive exploration drilling campaign, with most rigs operating around the clock. The exploration campaign has recently revealed several promising new pegmatites, with numerous targets still untested (Figure 5). Under the technical leadership of James Abson, Atlas Lithium’s recently hired Chief Geology Officer, the Company is targeting the release of a Maiden Resource Estimate in Q1 2024, conjointly with its first Preliminary Economic Assessment. In the interim, certain technical areas are being advanced to allow issuing a Definitive Feasibility Study in Q2 2024, to be designed around the Phase 2 production target of 300,000 tpa of battery grade spodumene concentrate.

Figure 5 – Six new and promising target areas (designated as Target Areas 1 through 6) within the Neves Project, complementing the four confirmed pegmatite bodies with spodumene mineralization (designated as Anitta 1 through 4).

Overall, the Company’s core strategy remains committed to strong ESG principles. Atlas Lithium is focused on sustainably producing premium spodumene concentrate, including plans to maximize water recycling, employ 100% dry stacked tailings without dams, avoid hazardous chemicals in flotation during the lithium concentration process, and planning to utilize renewable energy sources for power. Additionally, the Company continues building public and private partnerships to spur development in the Jequitinhonha Valley region and takes pride in serving as a sustainable job creator benefiting local communities.

About Atlas Lithium Corporation

Atlas Lithium Corporation (NASDAQ: ATLX) is focused on advancing and developing its 100%-owned hard-rock lithium project in Brazil’s Lithium Valley, a well-known lithium district in the state of Minas Gerais. In addition, Atlas Lithium has 100% ownership of mineral rights for other battery and critical metals including nickel, rare earths, titanium, and graphite. The Company also owns equity stakes in Apollo Resources Corp. (private company; iron) and Jupiter Gold Corp. (OTCQB: JUPGF) (gold and quartzite).

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward looking statements are based upon the current plans, estimates and projections of Atlas Lithium and its subsidiaries and are subject to inherent risks and uncertainties which could cause actual results to differ from the forward- looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of production, reserves, sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in Brazil, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. Therefore, you should not place undue reliance on these forward-looking statements. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: results from ongoing geotechnical analysis of projects; business conditions in Brazil; general economic conditions, geopolitical events, and regulatory changes; availability of capital; Atlas Lithium's ability to maintain its competitive position; manipulative attempts by short sellers to drive down our stock price; and dependence on key management.

Additional risks related to the Company and its subsidiaries are more fully discussed in the section entitled “Risk Factors” in the Company’s Annual Report and in Form 10-Q filed with the SEC on October 20, 2023. Please also refer to the Company’s other filings with the SEC, all of which are available at www.sec.gov. In addition, any forward-looking statements represent the Company's views only as of today and should not be relied upon as representing its views as of any subsequent date. The Company explicitly disclaims any obligation to update any forward-looking statements.

Investor Relations:

Michael Kim or Brooks Hamilton

MZ Group – MZ North America

+1 (949) 546-6326

ATLX@mzgroup.us

https://www.atlas-lithium.com/

@Atlas_Lithium